E-INVOICE

(IDR / Invoice Data Reporting)

A simple, cost-efficient and multi country add-on solution from Lupus Consulting helping companies to meet compliance needs on time at a minimum risk

BACKGROUND

There is a global wave of increasing control of Tax Authorities. In the European Union an additional incentive for setting up e-invoicing is the relevant European directive. This aims to have converted 50% of all invoices into e-invoices by 2020. The technology is now finally mature.

Update 2020

When is the due date for the new legislation?

The trial period will start on the 1st October 2020. During the trial period the SDI will still accept e-invoices compliant with previous technical specifications (version 1.5). Companies failing to update their solution may be subject to penalties after 1st January 2021 by the Italian Tax Authority.

What is new?

The SDI (Italian Tax Authority) has released a new version for the Italian e-Invoice solution, introducing changes to the XML content, to the XSD schema and in the SDI formal checks. The complete technical specifications are available on: https://www.agenziaentrate.gov.it/portale/specifiche-tecniche-versione-1.6.1

Two of the main modifications refer to new codes that indicates the type of document and the nature of the transaction. The codes are imperative to the setup of XML files.

Also 7 new document types have been introduced. Taxpayers will be required to identify the correct type of document for the transactions to be invoiced among the 18 different codes.

Similarly, 7 new codes have been added to identify the nature of the transaction. Taxpayers now have the possibility to identify among the 24 transaction types.

The types of transaction for VAT purposes will be indicated in more detail to make the invoicing process quicker and more precise.

Contact Person EN & GER

Name: Holger Kosboth

Email: holger.kosboth@lupusconsulting.com

Phone: +49 177 875 0 600

Contact person Italian

Name: Matteo Fontanari

Email: matteo.fontanari@lupusconsulting.com

Phone: +39 3404841944

MAIN FEATURES

- No need for additional SAP licenses, subscriptions (e.g. for SAP eDocument Framework or SAP Cloud Platform Integration Service)

- Quick and easy installation on internal company infrastructure

- Supports network setups where SAP is not connected to the internet

- Customization options enabling Clients to adapt to smaller changes in the law

- One common ALV dashboard functionality for monitoring communication

- Can manage more legal entities (company codes) in the same SAP client

- Can manage more SAP instances, or clients in the same legal unit

Contact Person EN & GER

Name: Holger Kosboth

Email: holger.kosboth@lupusconsulting.com

Phone: +49 177 875 0 600

Contact person Italian

Name: Matteo Fontanari

Email: matteo.fontanari@lupusconsulting.com

Phone: +39 3404841944

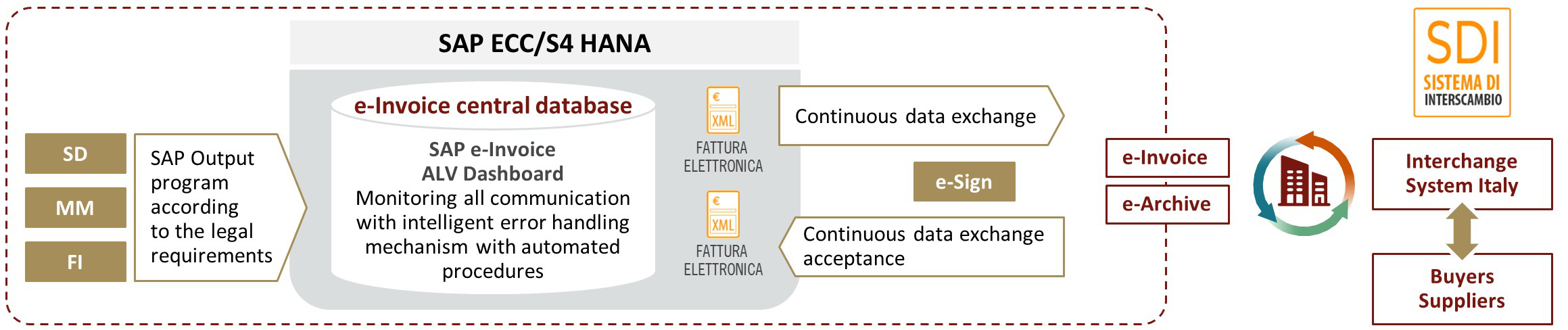

SOLUTION LANDSCAPE

-

A document, such as a sales invoice or a credit note, is created in SAP (SD, MM, FI)

-

A corresponding XML format, defined by the Italian tax authority, will be automatically generated. This standard is called FatturaPA. Official EU syntaxes will also be permitted

- A qualified signature is attached to the invoice, which is then sent via the SdI exchange system (Italian tax authorities)

- In the Lupus SAP e-Invoice Dashboard it is possible to monitor all statuses

- The Sistema di Interscambioalso provides the sender with invoice status notifications, as required by the legislation

- Approved documents will be sent back to the

customer by the government - Larger companies have the option to connect their

ERP systems directly to SdI in order to process invoices and notifications automatically

In Italy, electronic invoices must also be archived digitally. The requirements are complex. The retention period for invoices is ten years, during which time it must be ensured that the invoices cannot be altered. To achieve this, the archived invoices are grouped (pacchetti di archiviazione) and given a qualified electronic signature and a time stamp. This process must be completed no later than three months after the submission deadline for the annual tax return.

An other major advantage of B2B e-invoicing in Italy is the elimination of the Spesometro, a report of all tax- relevant business cases sent electronically to the Agency of Revenue. The Spesometro was introduced to decrease tax evasion, now it is unnecessary due to the transparency achieved with e-invoicing.

Italian Legal Requirements (including 2020 update)

The Italian government has announced that severe sanctions will be imposed if an organization does not comply with the new SDI regulations after the deadline of January 1, 2019. Invoices that are not submitted for approval through the SDI system will lead to penalties of 90% – 180% of the indebted VAT.

When do the new regulations start and who is affected?

- Starting on January 1, 2019, all invoices in the B2B sector must be sent electronically via SdI

- All suppliers and service providers registered in Italy which send invoices to Italian customers will be required to comply with this regulation

In order to make your SAP ERP system compliant with the SDI regulations, you may need to change some of your current invoicing and GRC processes:

- Company-specific data needs to be collected and mapped into the documents that are required by the Italian government

- Review Tax rules if all are up-dated

- Review business processes and the tasks/responsibilities linked to e-invoices

In order to manage electronic documents that have legal compliance aspects, Lupus provides an e-Invoice add- on. This framework facilitates the creation and processing of inbound and outbound documents that are created in SAP ERP. The solution is user-friendly, supports the country-specific standards and has an integrated dashboard to overview and manage processes.

The SDI has released in 2020 a new version for the Italian e-Invoice solution, introducing changes to the XML content, to the XSD schema and in the SDI formal check. Two of the main modifications refer to new codes that indicate the type of document and nature of transaction. The codes are imperative to the setup of XML files.

-

7 new document types have been introduced. Taxpayers will be required to identify the correct type of documents for the transactions

-

7 new codes have been added to identify the nature of the transaction. Taxpayers have the possibility to identify among 24 nature of transaction types.

IMPLEMENTATION METHODOLOGY

The Lupus Consulting

Lupus SixSquare is designed in a way that it is easily adaptable to support each project situation and need there- fore we ensure a rapid and timely implementation in standard cases in 2 weeks.

| TASK | TIMING | RESPONSIBLE |

| Assessment | Day 1 | Lupus Consulting |

| Contract and SOW acceptance | Day 1 | Client |

| Installation NAV Online invoice solution | Day 2, 3 | Lupus Consulting |

| Customization | Day 4, 5, 6 | Lupus Consulting |

| Training | Day 7 | Lupus Consulting |

| Support key user testing | Day 8 | Lupus Consulting |

| User test | Day 8, 9 | Client |

| Cut over plan, Go live | Day 10 | Lupus Consulting |

We are dedicated to be a partner for your company to stay compliant with our multi-country solution.

Over the past decade, tax administrations around the world have been engaged in a process known as channel shift. This involves moving away from face-to-face and postal contact with taxpayers to call centers and digital channels.

The primary driver was cost reduction, but tax authorities have also seen the potential in digital improvement to revolutionize compliance and increase tax income.

As a partner for e-invoicing and regulatory reporting, our mission is to keep track of upcoming regulations and provide the most user friendly and integrated solution.

Please refer to the webpage of the Italian government for further information on the legal requirements (The FatturaPA).

Contact us: Holger Kosboth | holger.kosboth@lupusconsulting.com | +49 177 875 0 600

Contact Person EN & GER

Name: Holger Kosboth

Email: holger.kosboth@lupusconsulting.com

Phone: +49 177 875 0 600

Contact person Italian

Name: Matteo Fontanari

Email: matteo.fontanari@lupusconsulting.com

Phone: +39 3404841944